Desmond Insurance Blog |

|

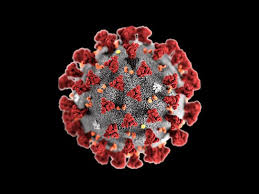

Kentucky's Commissioner of Insurance signed guidance, at the direction of Gov. Beshear, on March, 25th to ensure that Personal Auto Insurance will cover employees who are delivering food for their place of business. This is for businesses that do not normally offer delivery service but are now offering the service due to the COVID-19 shutdown. The guidance is available for download below.

0 Comments

To comply with Gov. Beshear's announcements and CDC recommendations we have closed our office to walk-in traffic in order to limit transmission of COVID-19. If you need to meet with someone to make a payment or discuss your coverage call us at 859-491-5100 or email [email protected].

We are still open for business, all of our employees are working remotely and have the access they need to assist you. Many insurance companies are suspending non-payment cancellations of policies due to COVID-19 through the first week of April. If you are our client and no longer working or working in a significantly decreased capacity, call us at 859-491-5100. If you are not our client, call your agent to find out if this applies to you.

Restaurant Owners: Are you delivering food due to the COVID-19 shut down? If you weren't delivering food before you may not have the right coverage in place. Several companies offer an endorsement to cover you with no addition cost if you already have a Commercial Auto policy. Call us at 859-491-5100 or email clines@desmondinsurance if you have any questions.

Most of the time, people don’t think about our car engines. They hop into the car and go where they want to go. However, when they start hearing sounds from the car, that’s a sign that the engine is breaking down. You need to look after your car engine, or you'll end up spending so much on it. Here are ways to proactively protect the most important part of your car.

Operating a restaurant requires you to protect your business with insurance. Many restaurant businesses do not have any insurance at all. Thus, in case they end up in trouble, they lose most of their funds, causing them to shut down momentarily or permanently. A business owner's policy, or BOP, is the standard package for those who want to get all the insurance policies that a restaurant needs.

Constructing your home or office is an exciting, challenging, and stressful experience. The last thing you want is to deal with a contractor who’s incompetent and unprofessional. After all, you’re making a substantial investment here. To make sure you get your money’s worth, look for these signs that indicate you’ve found a great contractor.

Desmond Insurance is pleased to announce that Eric Vieth has joined their team of agents. Eric will partner with individuals, families and business owners to efficiently protect their assets and plan for the future. Eric will continue to serve as an insurance agent for the Catholic Order of Foresters, as he has for the past five years. In addition, Eric has worked for Catholic Health Initiatives as a Project Manager and for Fidelity Investments as a Financial Services Project Manager. “Eric’s expertise and skill-set in the insurance and financial industries are a great fit for our team,” said Shannon Desmond Walz, Vice President at Desmond Insurance. “We’re excited to expand our team and to continue providing exceptional service for our clients and their businesses.” Eric earned his bachelor’s degree from Northern Kentucky University. He serves on the Development Committee for the Down Syndrome Association of Greater Cincinnati, as the Chairperson for Newport Central Catholic Business Networking Group, and recently served as the Parish Council Chairperson for St. Catherine of Siena. Desmond Insurance is a family-owned and operated agency serving clients in the Northern Kentucky and Greater Cincinnati area for more than 90 years. As an independent agency, Desmond represents many insurance companies enabling them to tailor coverage to fit various needs and budgets. For more information or a free quote call 859-491-5100 or [email protected]. Home-based businesses are booming these days. Half of the businesses in America alone operate from home. Most are under the assumption that their home insurance will cover their business. Unfortunately, it doesn’t work that way. Here’s why you should get a separate policy for your company.

|

Contact Us(859) 491-5100 Archives

July 2024

Categories

All

|

||||||

Navigation |

Connect With UsShare This Page |

Contact Us |

Location |

Website by InsuranceSplash

RSS Feed

RSS Feed